The Ultimate Guide to Market Cycles: A Framework for Intelligent Investing

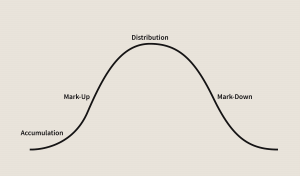

Financial markets, much like the seasons or the ocean tides, move in cycles. These recurring periods of expansion and contraction, of optimism and pessimism, are not anomalies to be feared but fundamental patterns to be understood. While no two cycles are identical in duration or magnitude, they are often driven by a predictable interplay of […]