In the fast-paced world of investing, it’s easy to get caught up in the latest hype, chasing “hot” stocks that are soaring. But what if the real treasures lie in the opposite direction – among the unloved, the neglected, and the temporarily “ugly” companies that the market has abandoned? Welcome to the powerful concept of building an “Ugly Duckling” portfolio.

What is an “Ugly Duckling” Stock?

An “ugly duckling” stock isn’t a bad company; it’s often a good company experiencing temporary, yet significant, headwinds. These headwinds could be:

- Negative headlines: Lawsuits, regulatory challenges, product recalls.

- Industry downturns: Cyclical industries in a slump, or sectors facing temporary disruption.

- Market overreaction: Investors punishing a company excessively for a minor misstep or a short-term dip in earnings.

- Lack of investor interest: Mature companies seen as “boring” compared to high-growth tech stocks.

The key is that the market sentiment is overwhelmingly negative, driving the stock price down to levels that do not reflect its underlying intrinsic value or long-term potential. While the crowd sells in fear, the contrarian investor sees an opportunity for exceptional returns.

Why They Become “Ugly” (and Why It’s Your Opportunity)

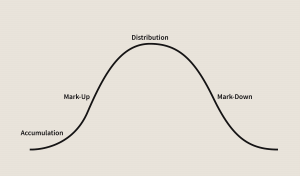

The herd mentality is a powerful force in financial markets. When bad news hits, investors tend to overreact, selling indiscriminately. This creates a disconnect: the company’s long-term business prospects might remain solid, but its stock price tanks due to short-term panic. This gap between price and value is where contrarians thrive.

By focusing on fundamentals rather than fleeting emotions, you can acquire quality assets at bargain prices. When the temporary issues resolve or market sentiment eventually shifts, these “ugly ducklings” have the potential to transform into beautiful swans, delivering outsized returns.

Case Study: Johnson & Johnson (J&J) – From Legal Woes to Resilience

Consider the case of Johnson & Johnson (J&J) during the 2018-2020 period. The healthcare giant faced a barrage of negative news, primarily related to lawsuits concerning its talcum powder products and its role in the opioid crisis. Headlines were grim, and public sentiment was heavily skewed against the company.

For many investors, J&J became an “ugly duckling.” Its stock price saw significant dips and periods of underperformance as legal uncertainties loomed. However, a contrarian investor would have looked beyond the immediate headlines. They would have seen:

- A fundamentally strong business: J&J boasts a diversified portfolio spanning pharmaceuticals, medical devices, and consumer health, with many iconic, resilient brands.

- Robust cash flow: The company consistently generates massive amounts of cash, enabling it to manage legal settlements without crippling its core operations.

- Long-term resilience: J&J has a century-long history of navigating challenges and adapting.

While many ran for the exits, a contrarian might have recognized that the legal issues, while serious, were unlikely to derail the entire enterprise. They would have accumulated shares when the stock was under pressure, betting on J&J’s underlying strength and the eventual resolution or containment of the lawsuits. True to form, J&J managed its legal challenges, and its stock eventually recovered and hit new highs, demonstrating the power of investing in an “ugly duckling.”

Building Your Own “Ugly Duckling” Portfolio:

- Focus on Fundamentals: Look for strong balance sheets, consistent profitability (even if temporarily depressed), durable competitive advantages (moats), and competent management.

- Understand the “Why”: Why is the stock out of favor? Is it a temporary problem or a permanent decline? Distinguish between a cyclical downturn and a structural decay.

- Practice Patience: “Ugly ducklings” don’t transform overnight. It takes time for the market to recognize their true value.

- Diversify: Even the best research can sometimes be wrong. Diversify your “ugly duckling” bets to mitigate risk.

By embracing the contrarian spirit and learning to spot value where others see only distress, you can unlock powerful investment opportunities and build a portfolio designed for long-term outperformance.