“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

— Benjamin Graham

When markets swing hard, emotions often take the wheel, leading to decisions that defy rational analysis. This phenomenon is particularly evident in two common investor behaviors: panic selling during sharp downturns and the fear-of-missing-out (FOMO) during euphoric rallies. As contrarian investors, our goal is to avoid these crowd-driven mistakes and act when others are trapped by their emotional biases. This article delves into the behavioral finance principles underpinning panic selling and FOMO, illustrates them with real-world U.S. stock examples, and outlines how disciplined minds can maintain control and potentially profit from the market’s irrationality.

The Bipolar Market: Fear and Greed in Action

The adage “The market is bipolar — irrational in fear, irrational in greed” encapsulates the core challenge investors face. While financial markets are theoretically driven by fundamentals, in practice, human psychology plays a profound role, often leading to significant deviations from intrinsic value. Understanding these psychological forces is crucial for developing a robust investment strategy.

1. Panic Selling: When Fear Overrides Fundamentals

Definition: Panic selling is a sudden, widespread divestment of assets, driven primarily by intense fear, unsubstantiated rumors, or a misunderstanding of market events, rather than a reasoned analysis of underlying fundamentals. It’s a classic example of how System 1 thinking—fast, intuitive, and emotional—can override System 2 thinking—slow, analytical, and logical—in high-pressure situations.

Cycle of Panic Selling:

The typical cycle of panic selling often unfolds as follows:

- Negative Shock: The catalyst is usually a significant negative event, such as a disappointing earnings report, adverse macroeconomic data, a geopolitical crisis, or a sudden, unforeseen event like a global pandemic.

- Rising Fear and Stop-Loss Triggers: As fear mounts, many investors, particularly those with predefined risk management strategies, see their stop-loss orders triggered. This automated selling further exacerbates the downward pressure.

- Snowball Effect: The initial sell-off creates a snowball effect, as more investors, seeing prices decline rapidly, decide to sell to cut their losses, leading to an accelerating drop.

- Market Halts/Circuit Breakers: In extreme situations, market halts or circuit breakers may be activated to temporarily pause trading, aiming to cool down the panic and prevent a complete meltdown.

- Capitulation and Trough Formation: Eventually, a point of “capitulation” is reached, where nearly all those inclined to sell have done so. This often coincides with the market reaching its trough, setting the stage for a potential rebound.

Examples from U.S. Stock Markets:

- 2020 COVID Crash: The onset of the COVID-19 pandemic in March 2020 triggered one of the fastest bear markets in history. The S&P 500 plummeted approximately 34% over just five weeks. News of widespread lockdowns, supply chain disruptions, and plummeting retail sales fueled intense fear. Many investors who liquidated their holdings in mid-March, driven by panic, subsequently missed the significant market rebound that began in late March and continued throughout the rest of the year. This period starkly illustrated how emotional selling can lock in losses right before a recovery.

- Netflix Q1 2022 Panic: In April 2022, Netflix shares plunged by roughly 30% after the company reported disappointing subscriber guidance, signaling a slowdown in growth. The news was amplified across social media, creating a wave of fear that even impacted other streaming-linked stocks, regardless of their own subscriber performance. While the immediate reaction was severe, for contrarian investors, this steep drop created a multi-month buying opportunity as the stock eventually recovered. This highlights how an overreaction to a single piece of news can present a value proposition.

2. FOMO: Herd Buying at the Top of the Market

Definition: Fear of Missing Out (FOMO) in finance is the psychological compulsion to buy rising assets, driven by an acute anxiety of missing out on significant gains that others appear to be making. It’s a powerful emotional driver that can lead investors to disregard fundamental valuation metrics and participate in speculative bubbles.

Cycle of FOMO:

The cycle of FOMO typically unfolds as follows:

- Initial Rally: The process often begins with an initial rally, perhaps driven by strong fundamental performance, institutional buying, or positive corroborative data.

- Momentum Traders Join: As the upward trend gains traction, momentum traders enter the market, pushing prices even higher, reinforcing the perception of rapid gains.

- Media Amplification: At this stage, financial news outlets and social media pick up on the rally, showcasing impressive returns and contributing to a narrative of unparalleled opportunity.

- Retail Investor Influx: FOMO kicks in for a broader segment of investors, particularly retail investors, who, fearing they will be left behind, begin to buy at new highs, often near the market’s peak.

- Euphoria and Reversal: The market enters a phase of euphoria, where optimism is detached from realistic earnings prospects. This period of peak excitement often precedes a market reversal, leaving late-comers with significant losses.

Examples from U.S. Stock Markets:

- IPO Mania (Circle & CoreWeave): Recent Initial Public Offerings (IPOs) have shown significant FOMO-driven activity. For instance, Circle reportedly rose 170% on its opening day, and CoreWeave surged 250% soon after their respective market debuts. Investors, fearing they would miss out on the “next big thing,” rushed into these offerings, often without adequate scrutiny of their underlying valuations, which were frequently extreme. Such parabolic rises often lead to subsequent corrections, punishing those who bought at the peak of the excitement.

- Nvidia AI FOMO: Nvidia’s meteoric rise, from approximately a $280 billion market capitalization in October 2022 to over $2.2 trillion by mid-2025, exemplifies a powerful FOMO-driven rally. Fueled by the excitement around artificial intelligence, both institutional and retail investors piled into Nvidia shares, often overlooking traditional valuation metrics that suggested the stock was significantly overvalued. While Nvidia’s underlying business is strong, the extreme price appreciation carried a high risk of drawdowns as market optimism became increasingly detached from immediate earnings potential.

- Meme-Stock FOMO (GameStop): The GameStop ($GME) phenomenon in early 2021 is a classic example of extreme FOMO and herd behavior. Coordinated buying pressure from online communities, particularly Reddit’s WallStreetBets, caused the stock’s price to spike violently. Investors, caught up in the fervor and the perceived opportunity for quick riches, bought shares at highly inflated prices. When the coordinated buying subsided and short squeezes unwound, the price collapsed, leaving many late-comers with substantial losses. This incident highlighted the dangers of speculative buying driven by social contagion rather than fundamental analysis.

3. The Psychology Behind It All: Behavioral Biases at Play

The common mistakes of panic selling and FOMO are deeply rooted in well-documented cognitive biases:

- Loss Aversion (Kahneman & Tversky): As articulated by Nobel laureates Daniel Kahneman and Amos Tversky, the psychological pain from experiencing a loss is generally felt more intensely than the pleasure derived from an equivalent gain. This bias often leads investors to sell too early during downturns to avoid further pain, even if it means missing a subsequent rebound.

- Herd Behavior & Social Proof: Humans have a natural inclination to conform to the actions of a larger group, believing that if many people are doing something, it must be the correct course of action. This “social proof” can be incredibly powerful in financial markets, leading investors to follow the crowd even against their better judgment, whether in selling during a panic or buying during a speculative frenzy.

- Anchoring: Investors often “anchor” their perceptions and decisions to an initial piece of information, such as their original purchase price for a stock. This can lead to holding onto losing positions for too long, hoping to recoup their initial investment, or conversely, selling winning positions too early because they’ve already achieved a certain profit from their anchored price.

- Recency Bias: This bias refers to the tendency to overemphasize recent events and trends, believing that they will continue indefinitely into the future. During a market downturn, recency bias can lead investors to believe that prices will continue to fall indefinitely, fueling panic selling. Conversely, during a bull market, it can foster the belief that gains will continue perpetually, encouraging FOMO buying at elevated prices.

According to Morgan Stanley, “panic-selling … can be the single most damaging thing an investor can do,” as it often locks in losses and ensures investors miss the subsequent rebounds that frequently follow periods of extreme fear.

4. How Contrarians Think Differently: Disciplined Action Against the Crowd

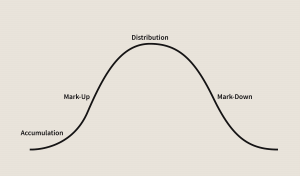

Contrarian investing is a strategy that goes against prevailing market trends, buying when others are selling (during panic) and selling when others are buying (during euphoria). This approach requires strong psychological discipline and a deep understanding of market cycles.

- 1. Stay Calm During Panic: Instead of succumbing to the urge to sell during short-term drawdowns, contrarians evaluate the intrinsic value of businesses. They recognize that quality companies with strong cash flows are often unfairly penalized during market panics, pricing in worst-case scenarios that may never fully materialize. Bounces often begin when fear dissipates, rewarding those who held firm or even added to their positions.

- 2. Resist FOMO Buying: Contrarians consciously resist the urge to buy into rapidly rising assets fueled by herd mentality. They understand that such rallies often lead to unsustainable valuations. Instead, they might use quantitative indicators, such as the percentage of stocks trading above their 5-day moving average, to gauge the extent of market exuberance and potential FOMO. They patiently wait for pullbacks or corrections to enter positions at more reasonable, fundamentally justified prices.

- 3. Use Quantitative Triggers: Advanced contrarians often employ quantitative tools and data analytics to identify market extremes. This includes tracking sector flows, analyzing valuation ranks across different assets, and monitoring sentiment extremes (e.g., put/call ratios, investor surveys). These data-driven insights help them identify when institutional activity reverses course and when contrarian setups—periods of maximum pessimism or excessive optimism—emerge.

- 4. Set Rules-Based Discipline: To mitigate emotional decision-making, contrarians often adhere to a strict set of rules. This includes defining clear stop-loss orders to manage downside risk and establishing predefined entry and exit thresholds based on their analysis, not on market noise or emotional impulses. Trading on objective data, rather than fear or hype, is paramount.

5. Smart Actions vs. Crowd Errors: A Contrarian’s Playbook

| Crowd Error | Description | Smart Contrarian Action |

| Panic Sell | Selling during short-term market drawdowns driven by fear. | Buy quality stocks when prices overshoot their downside, driven by irrational selling. |

| FOMO Buy | Buying near market peaks due to herd pressure and fear of missing out. | Wait for consolidation or significant corrections to deploy capital at more attractive valuations. |

6. Conclusion: Buy Fear, Sell Greed—With Discipline

The tendency for the crowd to sell at the peak of panic and buy at the crest of euphoria are typically poor long-term investment decisions. These actions often lead to “buying high and selling low,” the inverse of successful investing.

By consciously understanding the behavioral biases behind panic selling and FOMO, and by rigorously applying contrarian principles, investors can position themselves to “buy low and sell high.” This requires discipline, patience, and a willingness to stand apart from the crowd.

At Quantiverse.ai, our mission is to empower investors by providing the tools and insights necessary to:

- Spot emotional extremes in the market with data-driven precision.

- Quantify panic and greed levels, moving beyond anecdotal observations.

- Find hands-on contrarian entry and exit signals, transforming insights into actionable strategies.

By turning cycle awareness into a tangible financial advantage, investors can navigate the market’s emotional swings with greater confidence and achieve more consistent long-term returns. Visit Quantiverse.ai to learn more and refine your contrarian investment approach.