“Markets are driven by fear and greed — and the cycle between them never stops.”

If you’ve ever felt like markets are irrational, you’re not alone. But underneath the noise, most markets actually move in predictable phases — and learning to read these phases can give investors a serious edge.

At Quantiverse.ai, we believe the key to better timing, smarter positioning, and stronger returns lies in understanding the market cycle — and using that knowledge to act opposite the crowd. In this guide, we’ll break down the 4 stages of every market cycle, how to spot them, and when contrarians typically make their move.

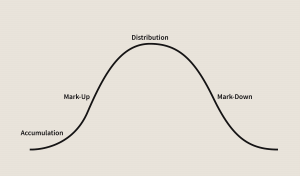

🔄 The 4 Phases of Every Market Cycle

Markets are never linear. Whether it’s stocks, commodities, or even crypto, all markets rise, peak, fall, and bottom — in repeating cycles.

Here are the four phases you need to recognize:

1. 📉 Accumulation Phase

What it feels like: Quiet. Fearful. Hopeless.

Who’s buying: Contrarians, insiders, and long-term thinkers.

This phase begins after a major decline, when prices have bottomed and panic is still in the air. Most investors have given up, media headlines remain negative, and sentiment is bearish.

But here’s the key: Prices stop falling. The smart money starts buying — not because the news is good, but because valuations are cheap, and the worst is likely over.

At this point:

- Valuations look attractive (P/E, P/B, etc.)

- There’s little competition to buy

- Volume is low, but price volatility flattens

💡 This is the phase where long-term wealth is built. Contrarians who step in here are often ridiculed — until prices start rising again.

2. 📈 Mark-Up Phase

What it feels like: Relief. Optimism. FOMO.

Who’s buying: Trend-followers, technicians, early adopters.

As the market begins climbing, momentum builds. Technical traders start seeing higher highs and higher lows. Media coverage turns more positive. Economic data is mixed but improving.

This is when most investors re-enter the market — and prices begin to rise quickly.

At this stage:

- Price action is strong; dips are bought quickly

- Trading volume increases

- Greed starts replacing fear

Eventually, euphoria kicks in. Even skeptics feel pressure to jump in — not wanting to miss out.

💡 Contrarians typically start reducing exposure near the end of this phase, when valuations stretch far beyond fundamentals.

3. ⚖️ Distribution Phase

What it feels like: Uncertainty. Mixed signals.

Who’s selling: Insiders, institutions, early buyers.

Here, the uptrend stalls. Prices stop making new highs. Sentiment is still positive, but cracks begin to show.

Investors disagree — some want to lock in gains, others are still hoping for more upside. As a result, the market enters a sideways range, sometimes with big intraday swings.

Common patterns:

- Double tops or “head and shoulders” formations

- Valuations remain high despite slowing earnings

- Price peaks with no new buyers

This phase can last weeks or months. It often ends with a sharp drop, triggered by bad news or a macro shock.

💡 If you’re still buying here, you’re likely late.

4. 📉 Mark-Down Phase

What it feels like: Pain. Panic. Capitulation.

Who’s selling: Retail investors, speculators, margin traders.

This is the most brutal part of the cycle. Prices fall fast and deep. Investors who bought near the top hold on, hoping to break even — until they eventually give up.

Selling becomes indiscriminate. Volume spikes. Headlines scream “recession” or “crash.”

During this phase:

- Volatility is high

- Valuations finally become attractive again

- The mood is overwhelmingly negative

But this is also when contrarians quietly begin preparing. As panic peaks, smart investors start looking for signs of stability — the early indicators of a bottom.

💡 When fear is greatest, opportunity is near.

⏱️ How Long Does a Market Cycle Last?

There’s no set length. Some cycles take months; others stretch across years.

It depends on the asset, macro conditions, and investor psychology.

| Asset Type | Typical Cycle Duration |

| Stocks | 1–5 years (on average) |

| Real Estate | 10–20 years |

| Crypto | 1–3 years |

| Day Trading | Several per day |

Regardless of the asset, what matters most is not the timing, but recognizing the phase you’re in — and positioning accordingly.

🧠 The Contrarian Edge

Contrarian investors use market cycles differently. They don’t chase trends. They buy when prices are hated and sell when they’re loved.

| Phase | Contrarian Action |

| Accumulation | Start building positions in undervalued assets |

| Mark-Up | Ride the trend; take profits on overextended winners |

| Distribution | Begin exiting high-flyers and raising cash |

| Mark-Down | Wait patiently for signs of capitulation, then re-enter selectively |

This approach takes discipline — and the ability to withstand short-term noise for long-term payoff.

At Quantiverse.ai, we use cycle-based analytics and sentiment tracking to help investors do exactly that.

🧭 Related Concepts: Value, Cyclical, and Contrarian Investing

- Contrarian Investing: Buying when others sell, based on cycle psychology

- Value Investing: Buying stocks below intrinsic value, often during market pessimism

- Cyclical Stocks: Companies that follow the economy (e.g. airlines, steel)

- Non-Cyclical Stocks: Defensive sectors like utilities or consumer staples

Understanding how different assets react at each phase helps you allocate smarter.

🧨 Final Thoughts: Use the Cycle, Don’t Fight It

Most investors react emotionally. They buy at the top (markup climax) and sell at the bottom (panic lows). Smart investors do the opposite.

If you recognize the cycle, you can act with strategy instead of emotion.

At Quantiverse.ai, we help you:

- Detect cycle shifts early

- Spot undervalued opportunities during market pessimism

- Avoid chasing bubbles at the top

📊 Explore the tools and dashboards built to help you invest with insight, not impulse.

👉 Visit Quantiverse.ai — start thinking in cycles.