“In the short run, the market is a voting machine; in the long run, it is a weighing machine.”

— Benjamin Graham

In public markets, price and value often diverge, sometimes dramatically and for prolonged periods. This misalignment is the cornerstone of value investing, where undervalued stocks—securities trading significantly below their intrinsic worth—offer disciplined investors a proven path to long-term outperformance.

At Quantiverse.ai, we combine capital cycle analysis with behavioral finance to pinpoint companies temporarily mispriced due to fear, neglect, or structural market shifts. These are not failing enterprises but fundamentally sound businesses suffering from market overreactions or apathy, presenting rare opportunities with asymmetric risk-reward profiles.

This article explores:

- The definition and characteristics of undervalued stocks

- Why markets persistently misprice quality businesses

- How undervaluation creates a “margin of safety” for contrarian investors

- Three modern case studies with detailed financial metrics and stock price charts

- Strategic insights for identifying and capitalizing on these opportunities

What Are Undervalued Stocks?

Undervalued stocks are equities trading at a significant discount to their intrinsic value, often due to temporary factors unrelated to their long-term operational health. Intrinsic value, as defined in academic finance, is the present value of all expected future cash flows, discounted at an appropriate rate. When market prices fall well below this theoretical value, a compelling investment opportunity emerges.

Common Indicators of Undervaluation:

| Metric | What It Suggests |

| Low P/E Ratio | Market underestimates future earnings potential |

| Low P/B Ratio | Stock is undervalued relative to net assets |

| High Free Cash Flow Yield | Company generates robust internal capital, overlooked by investors |

| Dividend Yield Above Sector Average | Effective capital distribution amid low market expectations |

However, not every “cheap” stock is a bargain. The goal is to identify quality at a discount—businesses with strong fundamentals, competitive moats, or resilient cash flows, not just low valuations. Distinguishing between a value opportunity and a value trap requires rigorous analysis of financial health, industry dynamics, and macroeconomic context.

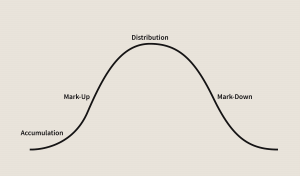

Why the Market Overlooks Undervalued Stocks

Financial markets are not perfectly efficient. Behavioral finance reveals that investors are swayed by herd mentality, cognitive biases, and short-term news cycles, leading to frequent mispricings. These inefficiencies are amplified during:

- Macroeconomic Uncertainty: Recessions, geopolitical tensions, or monetary policy shifts (e.g., Federal Reserve rate hikes in 2022–2023) trigger risk-averse sell-offs.

- Industry Downturns: Sector-specific challenges, such as the 2020 oil price collapse or the 2008 housing crisis, drag down even strong players.

- Reputational Crises: Scandals, such as data breaches or product recalls, spark panic-driven price drops.

- Earnings Volatility: Temporary factors like supply chain disruptions or currency fluctuations obscure long-term growth.

Markets often overreact to negative catalysts, indiscriminately selling off entire sectors or companies. Even resilient businesses with strong balance sheets can trade at distressed valuations, creating a classic setup for value investors.

Key Drivers of Mispricing:

- Short-Termism: Institutional investors’ focus on quarterly earnings overshadows long-term fundamentals.

- Narrative Dominance: Sensational headlines often drown out objective data, as seen in media coverage of corporate scandals.

- Liquidity-Driven Panic: During market drawdowns, institutions de-risk portfolios, triggering forced sales.

- Structural Biases: Passive investing vehicles like ETFs may sell stocks due to index rebalancing, regardless of fundamentals.

Macro Context (2020–2025): The past five years have been a perfect storm for mispricing. The COVID-19 pandemic, supply chain disruptions, inflation spikes, and central bank tightening created volatile sentiment swings. These conditions amplified undervaluation opportunities, as investors oscillated between euphoria (e.g., 2021 tech rally) and despair (e.g., 2022 bear market).

These inefficiencies open the door for contrarians to capitalize on market dislocations.

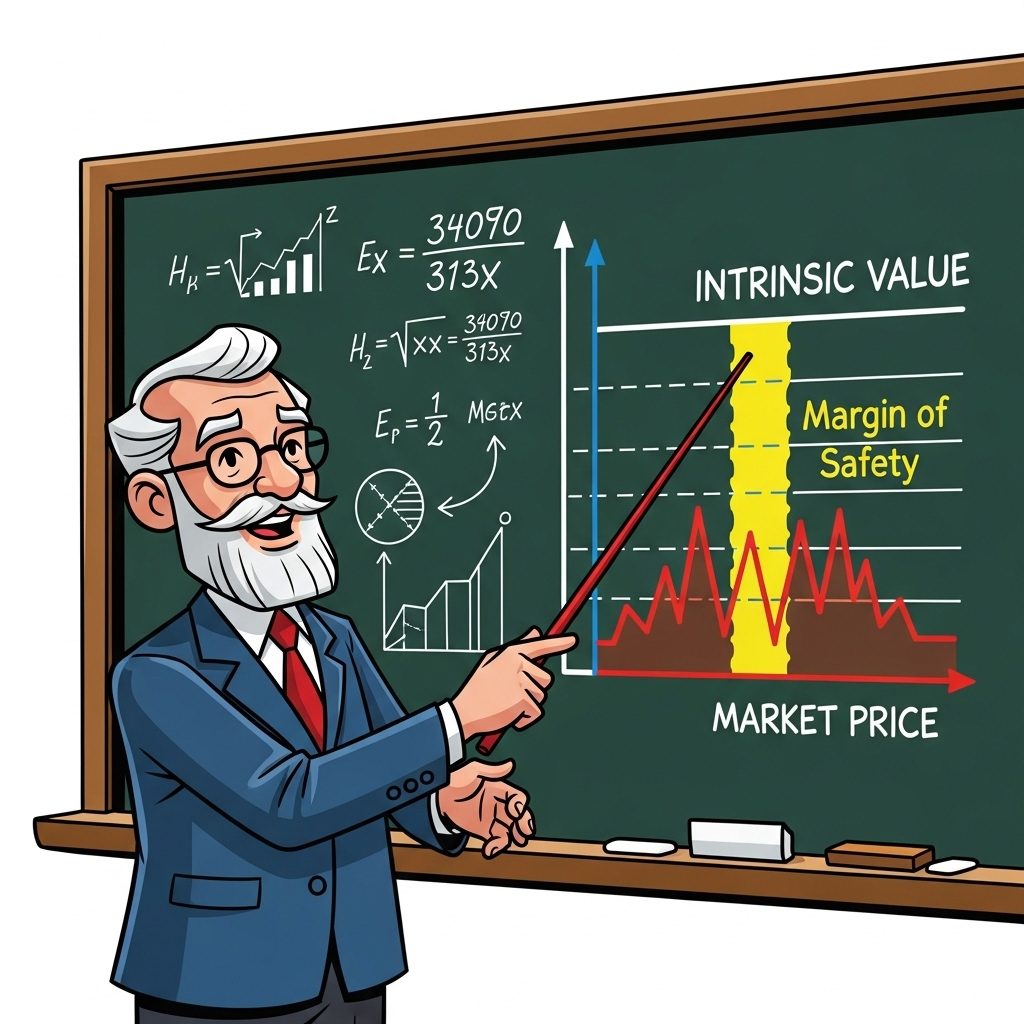

The Margin of Safety: Why Undervaluation Matters

Introduced by Benjamin Graham, the margin of safety is the gap between a stock’s intrinsic value and its market price. This buffer protects investors from analytical errors, adverse macroeconomic conditions, or unforeseen risks. Buying at a steep discount offers:

- Limited Downside: Most negative scenarios are already priced in, reducing potential losses.

- Amplified Upside: As valuations normalize or sentiment improves, returns can be substantial.

- Improved Risk-Adjusted Returns: Especially for companies maintaining earnings growth or dividends.

The margin of safety transforms undervalued stocks into investments with option-like characteristics: modest downside with significant upside potential. This asymmetry is particularly appealing in volatile markets, where uncertainty amplifies mispricings.

3 U.S. Stock Case Studies (2020–2024): From Overlooked to Outperforming

Below are three data-driven case studies from 2020–2024, showcasing how mispricing—driven by macroeconomic pessimism, sector biases, or short-term underperformance—created exceptional returns for value investors. Each includes financial metrics, risks, and stock price charts compared to the S&P 500 for context.

Case Study #1: Williams-Sonoma (WSM) – Consumer Retail Left Behind

- Valuation Low Point: Mid-2022

- P/E Ratio: ~7.3× (vs. 5-year average ~15×)

- P/B Ratio: ~2.5× (vs. sector average ~4×)

- 5-Year Return (2020–2024): +326% (vs. S&P 500: +85%)

- Sector: Consumer Discretionary

- Ticker: $WSM

The Situation (2022 Context): In 2022, fears of a housing market slowdown, coupled with 40-year-high inflation and Federal Reserve rate hikes, crushed consumer discretionary stocks. Williams-Sonoma, a premium home furnishings retailer, was traded as if it were on the brink of collapse, despite its industry-leading profitability.

Financial Metrics (2022):

- Gross Margin: >40%, among the highest in retail.

- Net Profit Margin: ~13.5%, nearly double the sector average.

- 3-Year EPS Growth: >50%, driven by e-commerce strength.

- Free Cash Flow: ~$1.1 billion, supporting dividends and buybacks.

- Debt-to-Equity Ratio: 0.4, reflecting a pristine balance sheet.

What the Market Missed:

- Williams-Sonoma’s asset-light, digital-first model thrived in the shift to online retail.

- Consistent capital returns via a 2.5% dividend yield and aggressive share repurchasing.

- Resilient demand for premium home goods, even in a slowing housing market.

Risks: A deeper-than-expected recession or prolonged inflation could have squeezed consumer spending. However, WSM’s strong margins and low debt mitigated these concerns.

The Result: By 2024, as inflation cooled and housing stabilized, WSM soared over 300% from its 2022 lows, far outpacing the S&P 500’s 20% gain over the same period. Contrarians who bought at peak fear reaped exponential rewards.

Chart showing WSM’s undervaluation in 2022 and +326% rally by 2024, compared to S&P 500.

Case Study #2: APA Corp. (APA) – Deep Value in Energy Cycle

- Valuation Low Point: Late 2020–Early 2021

- P/E Ratio: ~6× forward earnings

- P/B Ratio: <2× (vs. sector average ~3×)

- Recovery (2020–2022): +400% from pandemic lows (vs. S&P 500: +40%)

- Sector: Energy

- Ticker: $APA

The Situation (2020 Context): The 2020 oil price crash, triggered by COVID-19 demand destruction and a Saudi-Russia price war, pushed energy stocks to historic lows. APA Corp., an oil and gas producer, traded as if crude would stay below $40 per barrel indefinitely, despite its diversified assets.

Financial Metrics (2020–2021):

- Free Cash Flow Yield: ~15%, reflecting strong cash generation even in a downcycle.

- Net Income Growth: +42% in 2020, despite oil price pressure.

- Debt-to-Equity Ratio: ~2.8, manageable with cost-cutting measures.

- Asset Base: Undervalued offshore exploration assets in Suriname and the Gulf of Mexico.

What the Market Missed:

- Global oil supply was rebalancing, with OPEC+ cuts tightening markets.

- APA’s operational efficiency and low breakeven costs (~$35/barrel) ensured profitability.

- Long-term energy demand resilience, especially in emerging markets.

Risks: Prolonged low oil prices or a faster-than-expected transition to renewables could have pressured APA. However, its diversified portfolio and liquidity buffered these risks.

The Result: As oil prices rebounded to $70–$100 in 2021–2022, APA’s earnings surged, driving a +400% stock rally from its lows. Value investors who understood the capital cycle’s turning point captured massive alpha.

Chart illustrating APA’s collapse in 2020 and +400% recovery by 2022, outperforming S&P 500.

Case Study #3: United Airlines (UAL) – Overreaction to COVID

- Valuation Low Point: March 2020

- P/E Ratio: ~7.2× forward earnings

- Recovery (2020–2023): +200% from lows (vs. S&P 500: +50%)

- Sector: Transportation

- Ticker: $UAL

The Situation (2020 Context): The COVID-19 pandemic obliterated global air travel, sending airline stocks into a tailspin. United Airlines was priced for bankruptcy, despite securing $10.5 billion in CARES Act aid and executing aggressive cost cuts.

Financial Metrics (2020):

- Revenue Decline: -80% in Q2 2020, offset by a 50% reduction in operating expenses.

- Liquidity: Raised $15 billion via debt and equity, ensuring survival.

- Debt-to-Equity Ratio: ~4.5, high but manageable with government support.

- Market Position: Dominant U.S. routes and pricing power in key hubs.

What the Market Missed:

- Federal aid and restructuring ensured UAL’s solvency.

- Long-term travel demand was poised to rebound post-vaccine rollout.

- Industry consolidation strengthened pricing discipline among U.S. carriers.

Risks: Extended travel restrictions or a second wave of lockdowns could have derailed recovery. However, UAL’s liquidity and cost discipline provided a safety net.

The Result: By 2023, as travel demand normalized, UAL tripled from its March 2020 lows, outperforming the S&P 500’s 50% gain. Contrarians who bought at peak fear achieved outsized returns.

Chart showing UAL’s 72% plunge in 2020 and +200% recovery by 2023, compared to S&P 500.

Strategic Insights: How to Identify Undervalued Stocks

To capitalize on undervalued stocks, investors must blend quantitative rigor with qualitative judgment. Here are actionable strategies:

- Monitor Capital Cycles: Identify sectors or companies at the trough of investment or earnings cycles. Look for insider buying or reduced capital expenditures as early signals.

- Scrutinize Fundamentals: Focus on cash flow, balance sheet strength, and competitive moats. Avoid value traps with deteriorating business models.

- Compare Valuations: Use relative metrics (e.g., P/E vs. sector) and absolute metrics (e.g., DCF analysis) to confirm undervaluation.

- Assess Macro Context: Understand how economic cycles, monetary policy, or geopolitical events influence sentiment.

- Be Patient but Decisive: Wait for stabilization, but act before the crowd catches on.

Quantiverse.ai’s Approach: Our proprietary models analyze sector capital flows, valuation distortions, and sentiment indicators to rank undervalued stocks. By combining machine learning with fundamental analysis, we detect cycle reversals early, giving investors a data-driven edge.

Conclusion: Undervaluation Is Opportunity in Disguise

Contrary to efficient market hypothesis, prices are often wrong—especially during periods of panic, pessimism, or policy shifts. Undervalued stocks are not merely “cheap”; they are market anomalies waiting to be exploited by disciplined investors. By focusing on fundamentals, cycles, and margins of safety, you can turn market inefficiencies into long-term alpha.

Key Takeaways:

- Undervalued ≠ Broken: Strong businesses often trade at discounts due to temporary sentiment swings.

- Cycles Drive Opportunity: Mispricing is rooted in capital and sentiment cycles.

- Data Over Emotion: Let fundamentals and valuations guide your decisions.

- Patience Pays: The market eventually recognizes intrinsic value.

Discover Hidden Value Today

Visit Quantiverse.ai/dashboard to explore our real-time stock rankings, built on capital cycle methodology. Uncover undervalued gems before the market wakes up.