In the world of finance, the crowd often feels like the safest place to be. When everyone is buying, the urge to join in is powerful; when panic strikes, the instinct to sell overwhelms. But what if the path to true wealth lies in deliberately stepping away from the herd? Welcome to the intriguing world of contrarian investing.

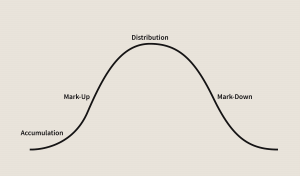

At its core, contrarian investing is about acting against the prevailing market sentiment. It’s about buying when others are fearful and selling when others are greedy, famously encapsulated by Warren Buffett’s timeless advice. This strategy is built on the belief that emotional extremes, driven by fear and greed, often lead to irrational market behavior and, consequently, mispricings. When optimism soars, assets become overvalued; when pessimism grips, they become undervalued. Contrarians seek to exploit these imbalances.

The roots of contrarian investing are deeply intertwined with value investing, pioneered by the legendary Benjamin Graham. Graham’s concept of “Mr. Market” perfectly illustrates the contrarian mindset: view the market as a moody partner who offers to buy or sell your shares at wildly fluctuating prices based on his current emotional state. A smart investor doesn’t let Mr. Market’s moods dictate their decisions but instead takes advantage of his irrationality. Graham emphasized the “margin of safety,” buying assets at a significant discount to their intrinsic value, thereby providing a buffer against unforeseen downturns.

Other titans have championed this approach. Humphrey B. Neill, with his seminal work “The Art of Contrary Thinking,” laid the psychological groundwork, arguing that when everyone thinks alike, no one is thinking very much. He stressed the importance of independent thought and skepticism towards widespread opinions. Sir John Templeton famously bought assets during times of “maximum pessimism,” making a fortune by investing in war-torn Europe during World War II. More recently, David Dreman applied a quantitative lens to contrarianism, demonstrating statistically that undervalued, out-of-favor stocks often outperform over the long run.

The success of contrarian investing hinges on behavioral finance – understanding how psychological biases like herd mentality, overconfidence, and recency bias distort market prices. By consciously avoiding these pitfalls, contrarians position themselves to capitalize on opportunities missed by the emotional majority. It’s a strategy that demands patience, conviction, and a willingness to stand apart, but for those who master it, the rewards can be substantial.