Every investor dreams of finding a super stock – that elusive company whose value multiplies tenfold, transforming a modest portfolio into a significant one. While Wall Street chases hype and headlines, these “10-baggers” are rarely found in the spotlight. In fact, they are often discovered in the market’s most neglected corners, waiting for a catalyst that most investors have completely overlooked.

This is the world of the contrarian, where fortunes are built by zigging when the market zags. By blending the principles of contrarian investing with market cycle theory, we can identify the common, yet subtle, characteristics of these hidden gems before they begin their meteoric rise. These are the powerful reversal signals that separate patient, analytical investors from the reactive crowd.

The Contrarian’s Edge: Why Popularity is the Enemy of Returns

The fundamental mistake most investors make is equating a popular company with a great investment. By the time a stock is a media darling, celebrated by analysts, and on every retail investor’s watchlist, the explosive growth phase is often already over. The “smart money” has already accumulated its position and is ready to sell to the incoming wave of excitement.

True super stocks are born from pessimism, not optimism. They are often:

- Ignored: The company operates in a boring or out-of-favor industry.

- Misunderstood: The market has punished the stock for a temporary problem while ignoring its long-term resilience.

- Recovering: The stock has suffered a major decline and is now forgotten, left for dead by momentum-chasers.

A contrarian investor understands that the point of maximum financial opportunity is often at the point of maximum pessimism.

The Market Cycle: Finding a Giant in the Basement

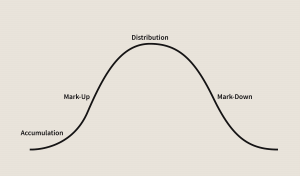

To pinpoint when to look for these opportunities, we turn to the four-stage market cycle theory. Nearly every stock moves through these phases:

Stage 1: Accumulation (The Base): This is the “stealth phase” after a significant decline. The stock trades sideways in a tight range as informed investors quietly buy shares from discouraged sellers. This is where hidden gems are found.

Stage 2: Markup (The Uptrend): The stock breaks out of its base and begins a sustained advance. This is when the public starts to take notice.

Stage 3: Distribution (The Top): After a massive run-up, the price becomes volatile and moves sideways. The smart money that bought in Stage 1 is now selling to the euphoric latecomers.

Stage 4: Decline (The Downtrend): The stock breaks down and enters a sustained downtrend as negative sentiment takes over.

Most investors try to buy during Stage 2, but the greatest risk/reward opportunities occur at the transition from Stage 4 capitulation into Stage 1 accumulation. This is the breeding ground for super stocks.

Three Overlooked Signals of an Impending Breakout

While a stock is languishing in Stage 1, it sends out subtle signals that a major reversal is brewing. Here are three of the most powerful—and most frequently ignored.

1. The Great Consolidation: A Long, “Boring” Base

After a painful Stage 4 decline, a future super stock doesn’t immediately rebound. Instead, it does something that frustrates most people: nothing.

The stock will often trade sideways for months, sometimes even years, carving out a long, flat base.

- What it looks like: A chart that moves horizontally with low volatility. Daily price swings are minimal.

- Why it’s overlooked: It’s incredibly boring. There is no news, no drama, and no reason for a momentum trader to pay attention.

- What it really means: This is the hallmark of accumulation. The ownership of the stock is quietly transferring from “weak hands” (impatient sellers cutting their losses) to “strong hands” (institutional and value investors who see long-term potential). The seller supply is drying up, setting the stage for an explosive move once demand returns.

2. Balance Sheet Strength, Not Income Statement Hype

In Stage 1, a company’s earnings report probably won’t impress anyone. Revenue growth might be flat or even negative. This is why most screening tools will miss it.

The real story isn’t on the income statement, it’s on the balance sheet.

- What to look for: Debt Reduction (is management actively paying down debt?), Improving Cash Flow (is the company generating positive free cash flow, even if profits are low?)

- Why it’s overlooked: Most investors are obsessed with quarter-over-quarter earnings growth. They screen for what’s hot now, not what’s becoming healthy.

- What it really means: The company is healing from the inside out. Management is creating a stable financial foundation that can support future growth, long before that growth ever appears in the headlines.

3. The Hidden Catalyst and Volume Contraction

Every Stage 2 breakout is fueled by a catalyst. In Stage 1, that catalyst is often invisible to the public but is being developed behind the scenes. It could be a new product, a new management team, a shift in industry dynamics, or a key patent.

The most reliable technical clue that this catalyst is nearing is volume.

- What it looks like: During the Stage 1 base, trading volume should become extremely low—it “dries up.” This signifies total seller exhaustion.

- The Reversal Signal: The first sign of a breakout is often a massive volume spike that pushes the stock price above the top of the basing range. A 200%, 500%, or even 1000% increase in average daily volume is a clear sign that the accumulation phase is over and the markup phase has begun.

- Why it’s overlooked: Investors who aren’t watching the stock will miss this initial move. They will only notice weeks later after the price is already up 50% or more.

Conclusion: The Art of Patient Observation

Finding super stocks is less about complex algorithms and more about mastering the psychology of the market. It requires the discipline to buy when others are fearful, the patience to hold through periods of boredom, and the analytical skill to look where no one else is looking.

The biggest gains are not found in the noise of the crowd, but in the silence of the accumulation phase. By focusing on beaten-down stocks building a strong financial base and waiting for the definitive reversal signal, you can position yourself for the life-changing returns that super stocks deliver.

Ready to apply these principles? Explore quantitative tools and market analysis at Quantiverse.ai/dashboard to start your search for the next hidden gem.