In a world of high-frequency trading and fleeting social media trends, it’s easy to believe that successful investing requires constant action. But what if the most powerful strategy wasn’t about reacting to daily noise, but about understanding the predictable, long-term patterns of the market? This is the essence of investing with the market cycle, a time-tested approach that allows investors to position themselves for success by recognizing which “season” the market is in.

Far from being a relic of the past, a clear cycle strategy is more relevant than ever. It provides a framework for making rational decisions, helping you to invest with the waves of the market rather than fighting against them.

What is a Market Cycle?

A market cycle is the period between two major peaks or troughs in the stock market. These cycles are a natural part of financial markets and are driven by a combination of macroeconomic factors, corporate earnings, and, most importantly, mass investor psychology. Just like the seasons of the year, market cycles have distinct phases, each with its own characteristics and optimal investment strategy.

While no two cycles are identical, they all follow a recognizable pattern. By learning to identify these stages, you can avoid buying at the peak of euphoria and selling at the bottom of despair.

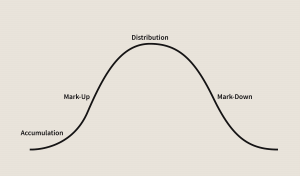

The Four Stages of the Market Cycle

Understanding the four-stage model, famously popularized by Stan Weinstein, is the first step toward building a robust cycle strategy. Every stock, index, and asset class moves through these phases.

Stage 1: Accumulation (The Market Bottom)

This phase occurs after a significant decline. Sentiment is at its worst. The news is overwhelmingly negative, and the average investor wants nothing to do with stocks.

Characteristics: Prices move sideways in a narrow range. Volatility is low. The general feeling is one of boredom or apathy.

Investor Psychology: Fear transitions to indifference.

The Smart Move: This is the “stealth” buying phase for contrarians and value investors. The risk is low, but it requires immense patience.

Stage 2: Markup (The Uptrend)

This is the phase most people associate with a bull market. The market breaks out of its accumulation base and begins a sustained upward climb.

Characteristics: A clear trend of higher highs and higher lows. Good news becomes more frequent.

Investor Psychology: Indifference turns to optimism, and eventually, excitement.

The Smart Move: This is the easiest time to make money. The strategy is to hold onto positions or buy into the early part of the uptrend.

Stage 3: Distribution (The Market Top)

After a long run-up, the market begins to lose momentum. The smart money that bought during Stage 1 now begins to sell their holdings to an ecstatic public.

Characteristics: Prices become highly volatile, swinging wildly with no clear direction. The news is overwhelmingly positive.

Investor Psychology: Excitement escalates into euphoria. The “Fear of Missing Out” (FOMO) is at its peak.

The Smart Move: This is the time to be cautious and begin selling.

Stage 4: Decline (The Downtrend)

The market breaks below its support levels and enters a sustained downtrend. This is a bear market.

Characteristics: A clear trend of lower highs and lower lows. Bad news starts to dominate.

Investor Psychology: Euphoria quickly turns to anxiety, which then devolves into fear and, finally, panic.

The Smart Move: The best positions are to be in cash or short the market.

The Cycle in Action: Lessons from US Market History

These stages aren’t just theoretical. They have played out time and again. Two of the most dramatic examples from recent US history are the Dot-com Bubble and the 2008 Financial Crisis.

Example 1: The Dot-com Bubble (Late 1990s – 2002)

Stage 3 (Distribution) & Euphoria (1999 – Early 2000): The NASDAQ Composite index soared. Internet companies with no profits, like Pets.com, went public and saw their valuations skyrocket. The media celebrated a “New Economy” where traditional valuation metrics no longer applied. This was classic euphoria, and smart money began distributing shares to a retail frenzy.

Stage 4 (Decline) & Panic (2000 – 2002): The bubble burst in March 2000. Over the next two and a half years, the NASDAQ collapsed by nearly 80%. Companies worth billions became worthless. Fear and panic gripped the market as investors who bought at the top saw their portfolios devastated.

Stage 1 (Accumulation) & Apathy (2002 – 2003): After the crash, what remained was a wasteland. Tech stocks were hated. The market traded sideways with low volume. This was the point of maximum pessimism and the beginning of the accumulation phase, where patient investors began buying the surviving, high-quality companies like Amazon.com and Apple at bargain prices.

Example 2: The Global Financial Crisis (2007 – 2009)

Stage 3 (Distribution) & Euphoria (2006 – 2007): The US housing market was the epicenter of this bubble. The belief that “housing prices only go up” was widespread. Financial institutions created complex mortgage-backed securities, and risk was ignored. As the stock market hit new highs in October 2007, the underlying housing market was already cracking – a classic sign of distribution.

Stage 4 (Decline) & Panic (2008): The collapse of Lehman Brothers in September 2008 triggered global panic. The S&P 500 plummeted over 40% in a matter of months. The dominant emotion was fear—fear of a complete collapse of the financial system.

Stage 1 (Accumulation) & The Bottom (March 2009): The market finally bottomed in March 2009 amid dire economic news and profound pessimism. It was the moment of capitulation. This marked the start of a new accumulation phase and, subsequently, one of the longest Stage 2 bull markets in history.

Conclusion: A Strategy for All Seasons

Investing with the market cycle is not about perfectly timing the top or bottom. That’s an impossible task. Instead, it’s about recognizing the dominant character of the market—as demonstrated by history—and aligning your strategy with it.

It teaches you to be aggressive when others are fearful (Stage 1), to ride the trend when it’s strong (Stage 2), to become defensive when others are greedy (Stage 3), and to preserve capital when the market is falling (Stage 4).

This timeless cycle strategy removes emotion from the equation and replaces it with a logical, repeatable process. By learning to identify these powerful waves, you can navigate any market with confidence.

Want to see where the market is in its current cycle? Use the advanced charting and analytical tools at Quantiverse.ai/dashboard to inform your strategy.