Quantiverse gives individual investors the tools to understand market cycles, avoid buying at peaks, and uncover undervalued stocks. Built by investors, for investors.

Almost every retail investor has faced this exact moment.

You spend hours, sometimes even weeks, researching a stock that looks incredibly promising. It’s everywhere. Everyone is talking about it on Reddit, X (formerly Twitter), and popular investing forums. Analysts are bullish, friends are talking about it, and the hype feels unstoppable.

Everything about this stock seems perfect. Its chart is following textbook technical analysis patterns. Quarterly revenue and earnings are growing rapidly. It just broke its 52-week high. The news is filled with glowing reports, and everywhere you look, the sentiment is overwhelmingly positive.

You think to yourself, “How could I possibly be wrong?”

The adrenaline kicks in. You press buy and imagine the fast profits you are about to make. In your mind, the outcome is certain: this stock is your next big win.

The Sudden Turn

At first, the stock moves slightly higher, giving you a satisfying feeling of validation. It confirms what you believed all along: you made the right call.

But then, things change.

The stock begins to slip. It drops 10 percent. Then 20 percent. Then 30 percent.

Suddenly, negative headlines dominate the news cycle. Stories emerge about supply chain problems, shrinking profit margins, and new competitors entering the market.

As the price falls further, you start questioning yourself. What did you miss? What went wrong after you had done so much research?

The Hidden Force Behind It All: Cycles

The truth is that this experience is not about you making a mistake. It is about cycles.

Cycles are a fundamental force that shape almost everything around us. The changing seasons follow a cycle. The Earth’s orbit around the sun follows a cycle. Tides rise and fall in predictable cycles. Economies expand and contract. Companies grow, plateau, and decline.

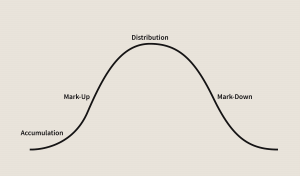

The stock market is no different. Prices move in cycles. Investor psychology moves in cycles. Even the behavior of individual stocks follows a cyclical pattern.

Understanding these cycles is crucial because they directly impact businesses and, in turn, the value of their stocks. Without recognizing them, investors are left vulnerable to the same frustrating experience of buying at the top and selling at the bottom.

What Makes Quantiverse Different

Quantiverse was designed to harness the power of cycles in the stock market.

Just as the overall market moves through broad cycles, every single stock has its own cycle. These are shaped by three interconnected forces:

- The natural business cycle, where changes in supply and demand affect profit margins and competition.

- The capital cycle, where money flows to where it can earn the highest return, constantly shifting across sectors and industries.

- The psychological cycle, where investor emotions swing between fear and greed, driving market behavior.

Quantiverse measures and interprets these forces using real data and proprietary algorithms. It removes emotional decision-making, hype-driven narratives, and market noise. Its ultimate purpose is to give individual investors the kind of powerful insight that has traditionally only been available to large institutional players.

Why Traditional Investing Tools Fail Retail Investors

Traditional investing tools often overwhelm investors with massive amounts of data while offering very little actionable insight.

You are bombarded with earnings reports, revenue projections, expert opinions, and endless financial ratios. Technical indicators and complex formulas make things even more confusing. Amid this noise, many investors end up relying on gut feelings or emotional reactions rather than clear, logical analysis.

Quantiverse takes a different approach. Instead of drowning investors in data, it focuses on delivering a single, powerful insight: whether a stock is undervalued and overlooked by the market or not.

This clarity allows investors to focus their energy on what truly matters. There is no hype, no emotional bias, and no unnecessary distraction—just a clean, data-driven signal.

Built by Investors, for Investors

Quantiverse is more than just a tool. It is a platform created by investors, for investors, with one clear mission: to level the playing field.

For too long, the advantage has been held by professional investors and large institutions with access to resources and analytics that the average retail investor could never afford. Quantiverse changes that by giving individual investors access to the same kind of deep, cycle-based insights that have guided the smartest money managers for decades.

By using Quantiverse, you gain the ability to stop buying at the peak of market euphoria and stop selling at the depths of panic. Instead, you can align your decisions with the natural cycles of the market and tap into the true essence of value investing./.