In investing, the crowd is often wrong. Going against it—being skeptical when everyone’s euphoric and optimistic when they’re panicking—is the heart of contrarian investing.

It’s a strategy that has powered nearly every world-class investor in history, from Warren Buffett to Seth Klarman. Why? Because it’s hard. It pushes against our natural instinct to follow the herd. But that’s exactly why it’s so profitable. If it were easy, the extra gains wouldn’t exist.

The good news is, you don’t need to be a genius to be a successful contrarian. You just need discipline. If you’re hunting for the best investments in 2025, the secret is to look where no one else is.

The Cost of Following the Crowd

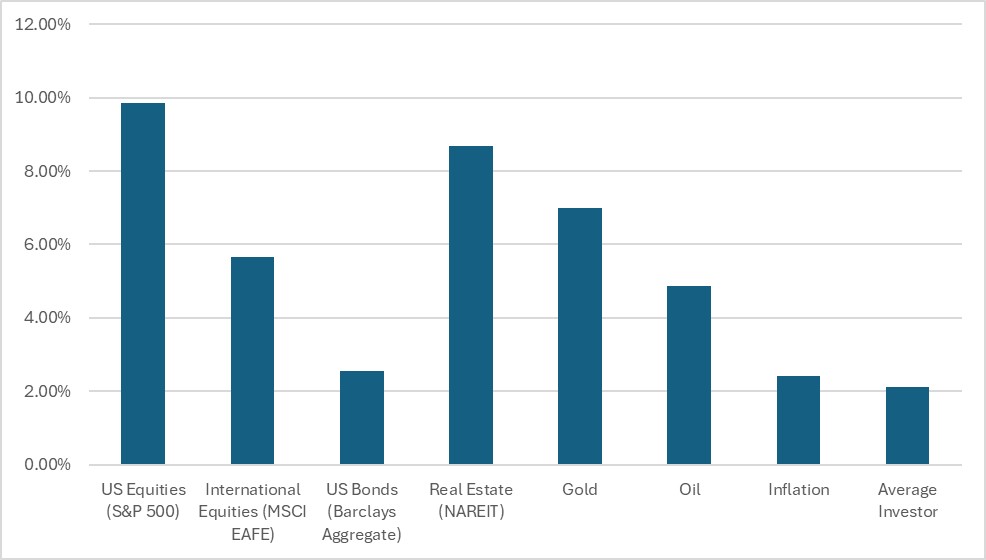

Data from JP Morgan paints a brutal picture: over the long run, the average investor’s portfolio gets crushed by a simple 60/40 stock and bond mix.

20-Year Annualized Returns by Asset Class (as of Dec. 31, 2023) (Chart Source: JP Morgan Guide to the Markets, citing Dalbar Inc.)

The reason for this massive underperformance is a simple, recurring mistake: investors chase hype. They pull money from funds that have recently done poorly and pour it into funds that have already skyrocketed.

They are literally buying high and selling low. This single habit is the difference between a comfortable retirement and a stressful one. People do the same with individual stocks, often selling everything and moving to cash after a market crash, locking in their losses and missing the inevitable recovery.

Contrarian Investing 101: The Simple Rules of Engagement

Being a contrarian isn’t about being a pessimist. It’s about being a realist.

- When the market is giddy and valuations are soaring, you become cautious, guided by math and history.

- When the market is terrified and everyone is selling, you get excited, because you can see how cheap great businesses have become.

This mindset is the common thread linking the investing giants. They saw value where others saw risk and avoided the expensive, popular stocks everyone else craved.

“I will tell you how to become rich. Close the doors. Be greedy when others are fearful, and fearful when others are greedy.” – Warren Buffett, CEO of Berkshire Hathaway

“Value investing is at its core the marriage of a contrarian streak and a calculator.” – Seth Klarman, Billionaire Hedge Fund Manager

“Buy value, not market trends or the economic outlook.” – Sir John Templeton, Billionaire Investor

“I am always prepared to do the right thing regardless of what other people think.” – Bill Ackman, Billionaire Activist Investor

These titans built their fortunes on a simple premise: the crowd is emotional, but numbers are rational. While everyone chased tech stocks in the dot-com bubble, Buffett bought 130 million ounces of silver at a historic low. When the world braced for war in 1938, John Templeton bought every stock on the American market trading for under a dollar and quadrupled his money.

They looked at the data, trusted their analysis, and placed their bets while everyone else thought they were crazy.

A Contrarian in Action: A Simple Example

Let’s say your portfolio is split across a few key sectors you understand well: Tech, Financials, Industrials, Gold, Energy Pipelines (MLPs), and Real Estate (REITs).

The Situation: Over the year, your Tech and Industrial stocks have a monster run, jumping 30%+. Your analysis (like a discounted cash flow model) tells you they’re now overvalued. Meanwhile, a market panic hits the real estate and energy sectors, pushing your REITs and MLPs down, even though their fundamental businesses are still sound.

The Contrarian Move: You trim your profits from the overvalued Tech and Industrial stocks that everyone is currently chasing. You then reallocate that capital into your beaten-down REITs and MLPs, buying more shares at a discount.

You aren’t just guessing. You’re moving capital because your quantitative analysis shows that the REITs and MLPs now offer a more attractive combination of dividend yield and growth potential for the price. You’re moving away from expensive assets and toward cheap ones.

You Don’t Need to Pick Stocks to Be a Contrarian

This strategy works just as well for index funds and ETFs. The key is to watch broad market valuation metrics.

The most famous is the Shiller P/E Ratio (or CAPE Ratio). Think of it as a long-term valuation thermometer for the S&P 500.

History shows a clear pattern:

- When the ratio is high (like in 1929 or 2000): The next 10-20 years of stock market returns tend to be poor.

- When the ratio is low (like in the late 1970s or 2009): The next 10-20 years of returns tend to be excellent.

When valuations get stretched, a contrarian might reduce their stock exposure or focus only on the cheapest international markets. When a crash brings valuations back to earth, they start buying aggressively.

A Safer Way to Be a Contrarian

Being a contrarian doesn’t mean you have to make high-stakes, all-or-nothing bets like Michael Burry in The Big Short. You can apply this mindset conservatively and effectively by following a few simple rules.

Don’t Short Stocks. Betting against a company is a high-risk game best left to professionals. When you’re wrong, your losses are theoretically infinite. It’s far safer to focus on buying great companies.

Avoid or Limit Margin (Debt). An investment portfolio without debt can survive any market storm. It removes the pressure and prevents you from being forced to sell at the worst possible time.

Stick to Companies with an “Economic Moat.” A moat is a durable competitive advantage—like a powerful brand (Apple), a network effect (Facebook), or a low-cost structure (Walmart). These businesses are resilient and can weather storms.

Watch Out for High Debt. Even a great company can be sunk by too much debt. If you’re taking a conservative approach, it’s often best to avoid companies with shaky balance sheets, even if they look cheap.

Diversify. Spreading your investments across different sectors, countries, and asset classes is the single best defense against losing a huge chunk of your capital quickly.

Advanced Move: Using Options as a Contrarian Tool

Options can be powerful tools for contrarians, allowing you to get paid for your patience.

Selling Cash-Secured Puts: This is like getting paid to set a lowball offer on a stock you already want to own. Let’s say a great company trades at $52, but you’d love to buy it at $46. You can sell a put option with a $50 strike price and collect a premium (say, $4/share). If the stock drops below $50, you get to buy it at your target price of $46 ($50 strike – $4 premium). If it stays above $50, you just keep the $4 and can repeat the process.

Selling Covered Calls: This is the opposite. It’s like getting paid to agree to sell a stock you own if the price spikes. If you bought a stock at $18 and it’s now trading at $33, you might think it’s overvalued. You could sell a call option with a $35 strike price. If the stock soars past $35, you sell your shares at a great profit. If it doesn’t, you keep the shares and the premium you collected for selling the option.

Where to Look for Contrarian Ideas in 2025

No one can predict what will happen in a single year. But a contrarian can tell you what looks cheap right now, giving you a powerful edge for long-term returns. Your biggest advantage as an individual investor is that you can focus on the next five years while Wall Street focuses on the next five minutes.

Idea #1: Keep an Eye on Emerging Markets

Historically, U.S. and emerging market stocks trade leadership in massive cycles. For the better part of a decade, U.S. stocks have dominated, leaving emerging markets in the dust and making them relatively cheap.

A potential long-term weakening of the U.S. dollar could also act as jet fuel for these markets. While the U.S. market is expensive by most historical metrics, many emerging markets offer lower valuations and higher growth potential. This doesn’t guarantee they will outperform in 2025, but it makes them a compelling area for a contrarian to research for the decade ahead.

Idea #2: Hunt for Undervalued U.S. Sectors

Even if the overall U.S. market seems pricey, there are almost always bargains hiding in plain sight. We’ve been in a long cycle where growth stocks have crushed value stocks. These trends don’t last forever.

To find contrarian ideas in 2025, look for the sectors that have been beaten down and forgotten. These are often industries like energy, materials, financials, or industrials that get ignored when flashy tech stocks are soaring.

The key is to sift through these unloved sectors to find the “diamonds in the rough”—high-quality companies that have been unfairly sold off with their weaker peers. While others are paying a premium for growth that’s already happened, you can position yourself in solid companies at prices that offer a margin of safety and significant upside.

Final Thoughts

Being a successful contrarian investor boils down to a simple, repeatable process:

- Gradually move your money away from popular, overvalued assets.

- Reallocate it toward unloved, undervalued assets.

- Use valuation metrics as your guide, not headlines.

- Follow strict safety rules to protect your capital.

It takes courage and discipline, but by thinking for yourself and betting against the irrational emotions of the crowd, you put yourself on the path to building real, long-term wealth.