Ever feel like you’re seeing something that everyone else is missing? In the world of investing, that instinct has a name: contrarian investing. It’s less about following the herd and more about using your own analysis to forge a different path.

At its core, contrarian investing is straightforward: you zig when the market zags. When everyone is frantically buying and FOMO is at its peak, a contrarian is often selling. When the market is panicking and selling off everything, the contrarian is coolly shopping for bargains.

One of the most legendary investors, Warren Buffett, summed it up perfectly: “Be fearful when others are greedy, and greedy when others are fearful.”

The “Why” Behind the Strategy

Contrarians operate on a simple but powerful observation about human nature: markets are often driven by emotion. The collective fear and greed of investors can push prices away from their true value.

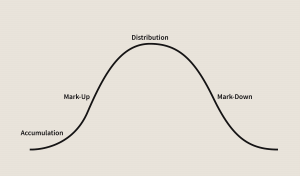

- Greed and Hype: When a stock is the talk of the town and everyone is piling in, its price can soar far beyond what the company is actually worth. The hype creates a bubble. Contrarians see this as a warning sign, a market peak with no room left to grow.

- Fear and Panic: Conversely, when bad news hits, panic selling can cause a stock’s price to plummet, falling well below its intrinsic value. A contrarian sees this pessimism as a potential buying opportunity.

Think of it as a market inefficiency. Contrarians believe that the “herd instinct” creates predictable patterns of overreaction, leading to mispriced assets. Their goal is to spot these mispricings and capitalize on them before the market comes to its senses.

Famous Contrarians: The Rebels of Finance

The history of finance is filled with contrarians who made fortunes by betting against popular opinion.

- Warren Buffett: During the 2008 financial crisis, when banks were on the brink of collapse and fear was rampant, Buffett invested billions in American companies, including Goldman Sachs. While many were selling in a panic, he was buying. That bold move paid off handsomely as the market recovered.

- Michael Burry: Profiled in the book and movie The Big Short, Burry was one of the few who predicted the collapse of the subprime mortgage market. He dug into the data, realized it was a house of cards, and made a massive bet against it. His deep research and willingness to defy conventional wisdom earned his fund a fortune.

- Sir John Templeton: A pioneer of global investing, Templeton’s strategy included buying into countries and companies when they were at the “point of maximum pessimism.” He famously bought shares of European companies at the start of World War II, a move that seemed unthinkable at the time but ultimately proved incredibly profitable.

Contrarian vs. Value Investing: What’s the Difference?

You might notice that contrarian investing sounds a lot like value investing. Both strategies involve searching for stocks that are trading for less than their intrinsic worth. The line between them is often blurry, but the key distinction lies in their focus:

- Value investors are primarily focused on the numbers—finding fundamentally strong companies that the market has undervalued for whatever reason.

- Contrarian investors are more focused on market sentiment. They specifically look for good companies that are being punished by widespread pessimism. In a sense, contrarianism is a type of value investing that uses popular opinion as a key indicator of where to look.

The Challenges of a Contrarian Approach

Going against the current isn’t easy. Here are some of the hurdles contrarians face:

- It Takes Time: Being a contrarian requires patience. You might buy a stock that you believe is undervalued, but it could stay that way for a long time before the market catches on. This can mean enduring periods of underperformance while waiting for your thesis to play out.

- Deep Research is a Must: You can’t just do the opposite of what everyone else is doing and expect to succeed. Contrarians must be masters of fundamental analysis. You need to do the homework to accurately determine a company’s true value and be confident in your assessment, especially when the entire market is telling you you’re wrong.

- The Psychological Pressure: It’s tough to stick to your guns when everyone around you is making money on the hot new trend or telling you that your bargain-bin stock is a lost cause. Successful contrarians need a strong stomach and unwavering conviction in their own research.

In short, contrarian investing is a powerful but demanding strategy. It’s for the independent thinkers, the deep divers, and those who trust their own analysis over the noise of the crowd.