The idea of “smart money” – typically referring to institutional investors, hedge funds, and seasoned professionals – suggests a consistent level of superior insight. And often, it’s true; they usually have more resources and information. However, even the “smart money” can, at times, turn “dumb” when swept up in the collective euphoria of a booming market. For the contrarian investor, recognizing when this happens is key to preserving capital and locking in profits.

The Illusion of Unstoppable Growth

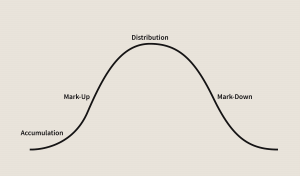

As a bull market matures, optimism becomes infectious. What starts as rational exuberance can morph into irrational complacency. Investors begin to believe that prices will only go up, that “this time it’s different.” Valuations stretch to unprecedented levels, justified by increasingly flimsy narratives. It’s during this phase that the “smart money,” too, can lose its discipline, chasing momentum rather than value, fearing they’ll be left behind.

This is the contrarian’s cue to become extremely cautious, even when it feels uncomfortable to be the lone voice of skepticism amidst universal bullishness.

Signs the “Smart Money” Might Be Getting Dumb (and It’s Time to Be Smart):

- Valuations Detach from Fundamentals: Companies trading at multiples far exceeding historical averages or their peers, with little fundamental justification.

- Increased Speculation: Penny stocks, “concept” stocks, and highly leveraged plays become popular. Initial Public Offerings (IPOs) are met with frenzied demand.

- Universal Optimism: Analysts are almost uniformly bullish, negative news is quickly dismissed, and market commentators declare the “end of bear markets.”

- Rise of “Greater Fool” Theory: The belief that even if an asset is overvalued, someone else will buy it from you at an even higher price.

- Exuberant Public Participation: Your taxi driver, barber, or distant relatives are giving you stock tips.

Case Study: Tesla (TSLA) at Peak Valuations (late 2021/early 2022)

Consider Tesla (TSLA) in late 2021 and early 2022. While undeniably a revolutionary company and a dominant force in the electric vehicle (EV) market, its valuation reached stratospheric levels. Its market capitalization briefly surpassed that of virtually all other major automakers combined (Toyota, Volkswagen, GM, Ford, Honda, etc.), despite producing a fraction of the vehicles.

- The Euphoria: Tesla had an incredible run, fueled by visionary leadership, technological innovation, and a passionate fan base. Analyst upgrades were frequent, and media coverage was overwhelmingly positive. Many institutional investors, including some “smart money” funds, continued to ride the momentum.

- The Contrarian View: A contrarian would have recognized the company’s strengths but questioned the valuation. Could Tesla truly justify a market cap greater than the entire traditional auto industry combined, given its current production and profit figures? While the future was bright, the price already discounted many decades of perfection. This extreme valuation, fueled by speculation and FOMO, was a clear signal of euphoria.

- The Action: A contrarian would likely have been selling or significantly trimming their positions in Tesla during this peak period, regardless of continued positive news flow, acknowledging that the price had simply run too far ahead of its fundamentals. They would have prioritized taking profits when the market was most generous.

- The Outcome: After peaking, Tesla experienced a significant correction in 2022, losing a substantial portion of its market value, before a subsequent recovery. This period highlighted how even a great company’s stock can become overvalued, leading to painful corrections for those who fail to recognize market exuberance.

Contrarian Lessons for Market Tops:

- Prioritize Valuation: Always tie price back to intrinsic value. If the narrative outweighs the numbers, be wary.

- Resist FOMO: The fear of missing out is a powerful emotion. Remind yourself that there will always be new opportunities.

- Take Profits: Don’t be afraid to sell a portion or all of your position when a stock becomes widely overvalued. It’s better to be early than late.

- Embrace Scrutiny: Be skeptical when optimism is universal. Look for the cracks in the narrative.

- Increase Cash Holdings: At market tops, cash becomes a valuable asset, ready to deploy when the market eventually corrects.

Being a contrarian at market tops isn’t easy; it requires courage to go against the prevailing optimism. But it’s often the most intelligent way to preserve capital and prepare for the next cycle’s opportunities.