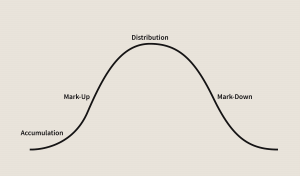

In the investment world, sectors, like stocks, go in and out of favor. One moment, technology is king; the next, it’s healthcare. But what happens when an entire industry falls out of grace? When investors shun it due to shifting narratives, temporary headwinds, or long-term skepticism? This is precisely where the contrarian investor often finds their most compelling opportunities.

In the investment world, sectors, like stocks, go in and out of favor. One moment, technology is king; the next, it’s healthcare. But what happens when an entire industry falls out of grace? When investors shun it due to shifting narratives, temporary headwinds, or long-term skepticism? This is precisely where the contrarian investor often finds their most compelling opportunities.

Investing in an “unpopular industry” means going against the current tide of capital flow and public sentiment. It requires conviction that the industry’s challenges are either temporary, overblown, or that a shift is inevitable.

Why Industries Become Unpopular (and Why It’s Your Chance):

- Cyclical Downturns: Many industries (e.g., commodities, manufacturing, banking) are inherently cyclical. During a downturn, sentiment becomes excessively negative, making them unpopular.

- ESG/Narrative Shifts: Changing societal values or investment trends (e.g., the focus on ESG – Environmental, Social, and Governance) can lead to widespread divestment from certain sectors, regardless of their immediate profitability.

- Disruption Fears: A new technology or business model emerges, creating existential fear for an established industry, even if the transition will take decades.

- Regulatory Headwinds: New government regulations or investigations can cast a long shadow over an entire sector.

When an industry becomes unpopular, capital flows out, valuations plummet, and even fundamentally sound companies within that sector can trade at bargain-basement prices. This creates an asymmetric risk-reward profile, where the potential upside significantly outweighs the downside.

Case Study: Energy Sector (Oil & Gas) During the ESG/Green Energy Push (2020-2021)

A striking example of an unpopular industry presenting a contrarian opportunity was the Energy Sector (Oil & Gas) during the 2020-2021 period. Fueled by growing awareness of climate change and the rise of ESG investing, there was a widespread narrative of “peak oil demand” and a rapid transition to green energy. Many investors and funds actively divested from traditional energy companies.

- The Unpopularity: Oil prices plummeted during the COVID-19 pandemic, and the long-term outlook for fossil fuels seemed dire to many. Major oil and gas companies like ExxonMobil (XOM) and Chevron (CVX) saw their stock prices languish and hit multi-year lows. They were seen as “dinosaurs” of a dying industry.

- The Contrarian View: A contrarian would have recognized the societal shift but also understood global reality. They would have noted:

- The world still heavily relies on fossil fuels for energy, transportation, and industrial processes.

- Underinvestment in new oil & gas production due to the ESG push could lead to future supply shortages.

- These companies often have strong cash flows and dividend yields, which became attractive at lower valuations.

- Their immense scale and infrastructure would make a rapid transition to renewables challenging, ensuring their relevance for decades.

- The Action: While the headlines proclaimed the demise of fossil fuels, contrarians bought into fundamentally strong energy companies, anticipating that supply-demand dynamics would eventually force a rebound in commodity prices and, consequently, their stock prices.

- The Outcome: As the global economy reopened and geopolitical events (like the war in Ukraine) highlighted energy supply constraints, oil and gas prices surged. Energy stocks, including ExxonMobil and Chevron, saw massive rallies in 2022 and beyond, delivering exceptional returns to those who dared to invest in the unpopular.

How to Identify Opportunity in Unpopular Industries:

- Fundamental Strength: Look for companies with low debt, strong balance sheets, and a history of profitability within the unpopular sector.

- Cyclical vs. Structural: Is the industry facing a temporary cyclical downturn, or a permanent structural decline? Distinguishing between the two is crucial.

- Catalyst for Change: Is there a potential catalyst (e.g., new regulations, innovation, shifting supply/demand) that could eventually reverse the industry’s fortunes?

- Valuation Matters: Ensure the sector’s companies are genuinely undervalued based on their future earnings potential, not just cheap because they’re dying.

Embracing unpopular industries requires patience, conviction, and a willingness to stand against the prevailing narrative. But for those who do, the rewards can be truly compelling.