You’ve done the research. You’ve found a fantastic company with a strong balance sheet, visionary leadership, and a best-in-class product. It seems like a foolproof investment. Yet, over the next year, the stock goes nowhere or, even worse, drops 30%. What went wrong? The answer may have nothing to do with the company itself and everything to do with its neighborhood: the industry sector it belongs to.

This is one of the hardest lessons for investors to learn: a great company in a struggling industry will often underperform a mediocre company in a thriving one. Understanding the industry cycle and the concept of sector rotation is not just an advanced technique—it’s a fundamental pillar of successful investing. This is why sometimes, the smartest move is to avoid a great stock completely.

Beyond the Company: Understanding Industry and Sector Cycles

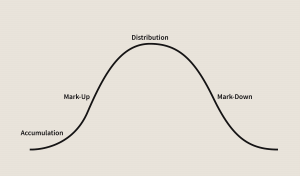

Just as the broader economy expands and contracts, individual industry sectors have their own distinct cycles of performance. These cycles are driven by macroeconomic trends, interest rates, inflation, and consumer behavior. Sector rotation is the investment strategy of moving capital from sectors that are peaking or declining to those that are poised to accelerate.

Think of it this way: “A rising tide lifts all boats.” In the stock market, the “tide” is often the performance of the sector itself. If an entire industry is facing strong headwinds, even the most seaworthy ship (the best company) will struggle to make progress.

The typical relationship between the economic cycle and sector performance looks like this:

1. Early Recovery (Leaving a Recession): As the economy bottoms out and interest rates are low, interest-rate sensitive sectors take the lead.

Outperforming Sectors: Financials (banks profit from a steeper yield curve), Consumer Discretionary (people start buying big-ticket items again), Real Estate.

2. Full Expansion (Strong Growth): The economy is growing robustly. Confidence is high.

Outperforming Sectors: Technology (companies invest in innovation), Industrials (building and manufacturing are in full swing).

3. Late Expansion (Approaching a Peak): Growth begins to slow, and inflation becomes a concern. Central banks may start raising interest rates.

Outperforming Sectors: Energy & Materials (commodity prices rise with inflation), Healthcare & Consumer Staples (investors start moving towards defensive names).

4. Recession (Contraction): The economy is shrinking.

Outperforming Sectors: Consumer Staples (people still need to buy food and toiletries), Utilities (demand is stable), Healthcare (non-elective procedures continue). These are “defensive” sectors that hold their value better than the overall market.

Sector Rotation in the Real World: Lessons from the US Market

These patterns are not just theoretical. They are a powerful force that has dictated market leadership in recent history.

Example 1: The Post-COVID Economy (2021-2022)

In late 2021, the US Federal Reserve signaled a major policy shift. To combat soaring inflation, they would aggressively raise interest rates.

The Impact on Technology (A Great Sector at the Wrong Time): Technology stocks, especially high-growth companies, are valued based on their future earnings. When interest rates rise, the present value of those future earnings falls dramatically. Throughout 2022, the technology sector was decimated. A fantastic, innovative company like Nvidia (NVDA), a leader in its field, saw its stock fall by over 60% from its peak. Was Nvidia a bad company? No. It was a great company in the absolute worst sector for a rising-rate environment.

The Impact on Energy (A “Boring” Sector at the Right Time): Conversely, the energy sector thrives on inflation and geopolitical instability. In 2022, the Energy Select Sector SPDR Fund (XLE) soared over 60%, making it the best-performing sector by a massive margin. An old-world oil company like ExxonMobil (XOM) dramatically outperformed the darlings of Silicon Valley. This was a classic late-cycle rotation.

Example 2: The Reopening Trade (2021)

As COVID-19 vaccines became widespread, the narrative shifted from lockdown to reopening. Companies that had benefited enormously from the pandemic, like Zoom (ZM) and Peloton (PTON), entered a brutal Stage 4 decline. These were still good, well-known companies, but their industry’s cycle had turned against them.

Meanwhile, “reopening” stocks like airlines, cruise lines, and retailers, which had been left for dead, began to rally as investors anticipated a return to normal economic activity.

Conclusion: Analyze the Industry First, Then the Stock

Industry analysis must be a core part of your investment process. Before you fall in love with a specific company, ask yourself:

- What stage of the economic cycle are we in?

- Which sectors tend to do well in this environment?

- Is the industry I’m looking at facing macroeconomic tailwinds or headwinds?

Failing to do so is like trying to swim against a powerful current. You might be the strongest swimmer in the world, but you will exhaust yourself and make little progress. By understanding industry cycles and positioning yourself in sectors with a tailwind at their back, you put the powerful forces of the market on your side.

Mastering sector rotation starts with the right data. Quantiverse.ai analytic tools do the heavy lifting, integrating all key rotation factors so you can instantly pinpoint winning sectors without the hours of complex analysis.