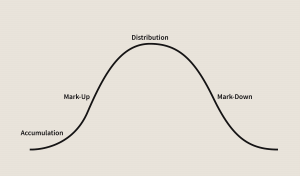

The mark-down phase of a market cycle is arguably the most dreaded. Characterized by falling prices, widespread pessimism, and often, economic recession, it can be a terrifying time for investors. The headlines are grim, portfolios shrink, and the urge to sell everything to stop the bleeding is almost irresistible. However, for the prepared investor – especially the contrarian – the mark-down phase is not just about survival; it’s about setting the stage for future wealth creation.

Characteristics of the Mark-down Phase:

- Falling Prices: A sustained and significant decline in stock prices (a bear market).

- Negative Sentiment: Fear and panic are widespread. Investors are capitulating, selling indiscriminately.

- Economic Contraction: Often accompanied by a recession, rising unemployment, and declining corporate profits.

- High Volatility: Sharp daily swings, often exacerbated by emotional selling.

- Bad News Dominates: Every news outlet is filled with stories of economic woe and corporate failures.

While the herd is focused on protecting what’s left, the contrarian views this phase as a cleansing process, washing out excesses and creating once-in-a-decade opportunities.

Your Survival Guide for the Mark-down Phase:

Prioritize Capital Preservation:

Reduce Exposure: If you weren’t defensively positioned before the downturn, consider trimming highly speculative or overvalued assets to protect your remaining capital.

Increase Cash Holdings: Cash becomes king in a bear market. It provides liquidity for emergencies and ammunition for future opportunities.

Focus on Quality: Shift towards companies with strong balance sheets, consistent free cash flow, and low debt. These are more likely to weather the storm.

Manage Your Emotions, Not Just Your Portfolio:

Avoid Panic Selling: Selling at the bottom locks in losses. Unless your fundamental thesis for a company has genuinely broken, resist the urge to liquidate everything.

Turn Off the Noise: Limit exposure to sensationalist financial news that fuels fear.

Focus on the Long Term: Remind yourself that market downturns are temporary and part of a natural cycle.

Identify Opportunities (The Contrarian Advantage):

Value Hunting: This is when quality companies go on sale. Look for fundamentally sound businesses trading at multi-year lows, often below their intrinsic value.

Dollar-Cost Averaging: Instead of trying to time the exact bottom, commit to investing a fixed amount regularly. This averages out your purchase price over the downturn.

Rebalance Strategically: As certain assets become extremely cheap, rebalance your portfolio by selling relatively strong assets and buying more of the distressed, high-quality ones.

Case Study: The 2008 Financial Crisis – A Buying Opportunity in the Rubble

The 2008 Financial Crisis represents one of the most severe mark-down phases in modern US history. The collapse of the housing bubble, the subprime mortgage crisis, and the failure of major financial institutions like Lehman Brothers sent shockwaves through the global economy. Stocks plummeted, unemployment soared, and fear reached unprecedented levels.

- The Panic: Many investors, including institutions, sold indiscriminately. Financial stocks, in particular, were decimated, with giants like Bank of America (BAC) and JP Morgan Chase (JPM) seeing their share prices fall dramatically.

- The Contrarian’s Play: While the market was predicting the end of the financial system, savvy contrarians, notably Warren Buffett, recognized that the US financial system, though wounded, would eventually recover. They had the conviction to buy when others were selling. Buffett notably invested heavily in Goldman Sachs (GS) and Bank of America (BAC) during the depths of the crisis, seeing their long-term potential despite short-term pain.

- The Outcome: As the economy stabilized and financial institutions recovered, the stock prices of these companies rebounded dramatically, rewarding those who had the courage and foresight to buy during the mark-down phase. This period starkly highlighted that the deepest fears often coincide with the greatest buying opportunities.

The mark-down phase is challenging, but it is also where fortunes are made. By preserving capital, managing emotions, and diligently seeking out undervalued opportunities, you can not only survive but truly thrive when the inevitable rebound begins.