“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffett

Value investing is more than just a famous quote — it’s a time-tested strategy for uncovering hidden opportunities where most see only risk.

At Quantiverse.ai, we harness the power of market cycles, capital cycles, business cycles, and sentiment cycles to detect undervalued companies with solid fundamentals that have been temporarily ignored or mispriced due to fear. These moments are where the best long-term investment opportunities emerge.

In this article, you’ll learn how to identify undervalued stocks near the bottom of their cycle and see how this strategy has worked in practice, with three compelling case studies: Apple, Equifax, and United Airlines — all companies once left for dead by the market, only to stage powerful comebacks.

What Is Value Investing?

Value investing is the art of going against the trend. Instead of chasing the hottest stocks, value investors search for overlooked and undervalued companies, especially during moments of widespread panic.

This approach is rooted in understanding two critical dynamics:

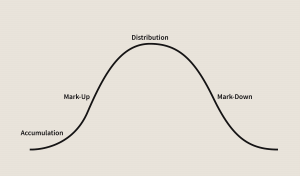

🔄 Market Cycles

The emotional rise and fall of investor sentiment, often swinging between bull markets and bear markets in response to macroeconomic trends.

💸 Capital Cycles

The flow of money into and out of industries or companies. Capital inflows often lead to overvaluation, while capital flight typically leaves businesses undervalued and ignored.

By investing at the bottom of the cycle — when pessimism peaks — value investors position themselves to gain as fundamentals normalize and sentiment shifts.

This is how investing legends like Warren Buffett, Howard Marks, Charlie Munger, and Ray Dalio have achieved extraordinary results. Now, let’s see how it works in action.

📈 Case Studies: U.S. Stocks That Rebounded After Being Left for Dead

Here are three real-world examples of U.S. stocks that suffered major downturns — only to deliver strong returns for investors who recognized their true long-term value.

🧠 Case #1: Apple Inc. (AAPL) – Overreaction to iPhone Sales (2018)

- Downturn Period: Oct–Dec 2018

- Drop: ~30%

- Recovery Period: Jan–Jun 2019

- Ticker: $AAPL

Market Context

In late 2018, Apple shocked Wall Street by slashing its iPhone sales forecast. The U.S.–China trade war, rising interest rates, and fears of a global recession triggered a broad sell-off. AAPL plunged from ~$230 to ~$142 in just three months — a ~30% drop.

Financials Behind the Fear

Despite the panic, Apple’s fundamentals remained strong:

- P/E Ratio: Fell to 12× forward earnings — cheap compared to its historical 15–20× average

- Free Cash Flow: Over $60 billion in 2018

- Debt/Equity Ratio: A safe 0.87

- Revenue Growth: Services (App Store, Apple Music) and wearables (Apple Watch) grew 20% YoY

Critics pointed to Apple’s dependence on iPhone sales and Android competition. But the market reaction ignored its cash position, ecosystem strength, and revenue diversification.

Long-Term Performance

By June 2019, AAPL had rebounded ~50% from the bottom and resumed its upward trajectory. In 2025, Apple remains a global leader, fueled by strong services growth and continuous product innovation.

🧠 Case #2: Equifax Inc. (EFX) – Panic After a Data Breach (2017)

- Downturn Period: Sep 2017

- Drop: ~35%

- Recovery Period: Oct 2017–Mar 2018

- Ticker: $EFX

Market Context

In September 2017, Equifax revealed a massive data breach affecting over 140 million individuals. Public outrage and lawsuits followed. Shares dropped 35% in a single week.

Financials Behind the Headlines

- P/E Ratio: Dropped to 15×, far below its 20–25× norm

- Revenue Stability: Core credit reporting and analytics remained profitable

- Legal Costs: Fines estimated at ~$500M — large, but manageable given annual revenue of $3.5B

While lawsuits and reputational damage were legitimate concerns, Equifax’s dominant market position in credit reporting remained intact.

Long-Term Performance

Within 3–4 months, EFX rebounded ~40% as panic faded. By 2025, Equifax not only recovered but strengthened its role in the credit industry, fueled by rising demand for cybersecurity solutions.

🧠 Case #3: United Airlines (UAL) – COVID Collapse and Rebound (2020)

- Downturn Period: Jan–Mar 2020

- Drop: ~72%

- Recovery Period: From March 2020 onward

- Ticker: $UAL

Market Context

The COVID-19 pandemic paralyzed the airline industry in early 2020. UAL stock plunged from $90 to $24 as travel vanished and bankruptcy rumors grew. But government stimulus offered a lifeline.

Financials During Crisis

- Debt/Equity Ratio: Rose to 4.5 — high leverage

- Cash Reserves: Raised $15B via debt and equity offerings

- Revenue Impact: Q2 2020 revenue fell 80%, offset by aggressive cost-cutting

Despite short-term chaos, United Airlines had the liquidity and scale to survive.

Long-Term Performance

By mid-2021, UAL had doubled from its lows. By 2023, it was up over 200%, benefiting from the global travel resurgence. In 2025, it continues to capitalize on post-pandemic tourism growth.

🧠 Key Lessons: How to Find Value Through Cycles

Want to master value investing? Here’s what these cases teach us:

- Track Panic Selloffs: News-driven crashes often overcorrect reality

- Analyze Capital Cycles: Look for industries at capital or earnings troughs

- Prioritize Fundamentals: Focus on companies that can survive a crisis

- Hunt for Valuation Gaps: Buy when the market underestimates resilience

- Time Your Entry Wisely: Wait for stability — but not too long

At Quantiverse.ai, our tools analyze capital flow data, sector momentum, and valuation anomalies to identify overlooked stocks with upside potential.

Conclusion: Discipline Over Emotion Wins the Cycle Game

Value investing isn’t about being contrarian for the sake of it. It’s about staying disciplined when others panic.

Markets tend to overreact — in both directions. For investors who stay grounded in data and cycles, these overreactions create prime opportunities.

✅ Ready to Discover Your Next High-Potential Stock?

Visit Quantiverse.ai to explore our stock ranking dashboard, powered by capital cycle analytics and contrarian insights.

Find the next big opportunity — before the crowd does.