Every day, the financial media bombards us with a relentless stream of headlines: company earnings, economic data, analyst upgrades/downgrades, geopolitical events, and endless speculation. For most investors, this “noise” can be overwhelming, leading to knee-jerk reactions that often destroy wealth. But for the contrarian, this very noise presents an opportunity.

Contrarians don’t ignore the news; they filter it. They understand that market prices are often driven by emotional reactions to information, not just the information itself. Their goal is to look beyond the sensationalism, past the short-term panic or euphoria, and through the herd’s immediate response, to uncover the underlying fundamental reality.

The Contrarian’s News Filter: What to Ignore, What to Focus On

- Ignore the “Emotional Amplification”: News, especially negative news, is often amplified by media and social sentiment, leading to exaggerated market reactions. Contrarians recognize this overreaction.

- Example: A company misses quarterly earnings estimates by a small margin, and the stock tanks 15%. The noise focuses on “disappointment” and “underperformance.”

- Focus on the “Fundamental Impact”: Does this news fundamentally change the company’s long-term earnings power, competitive advantage, or balance sheet strength?

- Contrarian Filter: Is that 15% drop justified by a minor earnings miss, or is the market overreacting? Is the core business still intact? Is the long-term growth story still valid?

Why the Herd Reacts, and Why You Shouldn’t

The majority of investors react impulsively to news due to several behavioral biases:

- Recency Bias: Overweighting recent events, leading to the belief that current trends will continue indefinitely.

- Availability Bias: Overestimating the likelihood of events that are easily recalled (e.g., highly publicized failures).

- Herd Mentality: Following the actions of a larger group, assuming they know something you don’t.

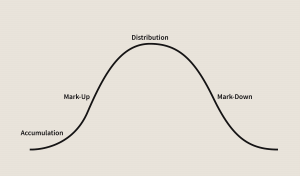

Contrarians actively fight these biases. They know that extreme emotional responses by the market often create the best buying opportunities (when fear is rampant) or selling opportunities (when euphoria takes over).

Case Study: Netflix (NFLX) During Subscriber Slowdowns (2022)

A prime example of filtering noise came in 2022 with Netflix (NFLX). The streaming giant, once a darling of growth investors, announced its first subscriber loss in over a decade and forecasted further slowdowns. The news sent shockwaves through the market, and Netflix’s stock plummeted by over 70% from its peak. The headlines screamed “Netflix is dead,” “Streaming war loser,” and “End of an era.”

For many, this was a clear signal to sell or avoid. The noise focused on the immediate subscriber numbers and the intensifying competition.

However, a contrarian investor would have applied their news filter:

- Emotional Amplification: Recognize the panic. A 70%+ drop for a company with millions of subscribers, a massive content library, and global reach seemed like an extreme overreaction to slowing growth, not outright decline.

- Fundamental Impact: Did this news fundamentally break Netflix’s business model? Was streaming going away? Was Netflix losing its ability to produce popular content? The answer was no. While growth was slowing, the underlying business was still generating substantial revenue and cash flow, and streaming remained a dominant form of entertainment.

A contrarian might have looked beyond the immediate subscriber numbers and considered Netflix’s long-term strategic position, its pricing power, and its continued investment in diverse content. They would have seen a company hitting a temporary speed bump, not a brick wall. While the short-term noise was deafening, the long-term signal for a resilient, albeit maturing, business remained. Those who looked past the panic and bought into the perceived weakness have since seen the stock show strong signs of recovery.

Your Action Plan to Filter the Noise:

- Question the Obvious: If everyone is saying the same thing, pause and ask yourself if there’s a different perspective.

- Drill Down to Fundamentals: Always ask: How does this news truly impact the company’s long-term earnings, balance sheet, competitive advantage, and intrinsic value?

- Assess Sentiment: Pay attention to how extreme the market’s emotional reaction is. Is it panic or euphoria? Extreme sentiment often creates opportunities.

- Prioritize Quality Sources: Stick to factual reporting and detailed financial statements over sensationalist headlines.

By training yourself to filter the endless stream of news, you can transform it from a source of confusion into a powerful tool for identifying genuine investment opportunities.